A recent study performed by U.S. Bank indicated that 82% of startups in the United States fail due to not properly maintaining cash flow or the understanding of how cash flow impacts the overall business. Ensuring that your business has sufficient cash to operate goes far beyond the revenue you earn and necessary expenses.

Many businesses are able to run a profitable business, but still run out of money. How is this possible?

EXAMPLE #1

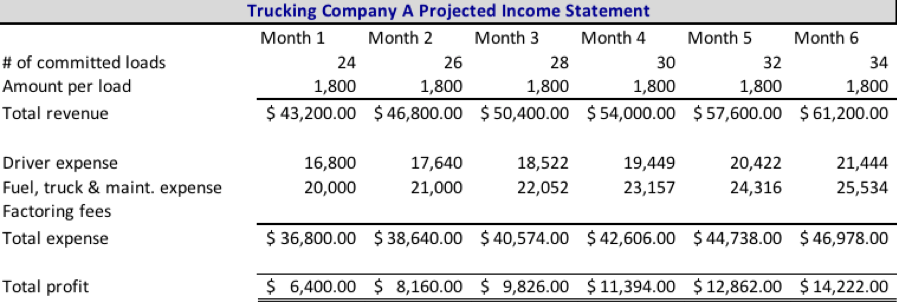

Trucking Company A is a new business that has taken every measure to be successful. They have top of the line equipment, best-in-class drivers and commitments from shippers that will keep them busy for months to come. They even have $40,000 in startup capital to handle emergency expenses. As they map out their future income statement, it looks like this:

Looks pretty exciting, right? If Trucking Company A is able to operate their business according to plan, how could it possibly fail?

Let’s assume that Trucking Company A’s top shippers are very strong and reputable companies that have a very strong credit backing. Like many strong companies out there, they will likely negotiate payment terms around 30 days out, plus we all know it takes 5-10 days on top of that before we actually receive the funds in hand. Despite having a strong income statement, the cash flow statement will look like this:

It becomes easy to see how a strong, healthy trucking company with great operations and great customers can always feel desperate for cash. Managing cash flow is a problem that affects far more than the trucking industry. Retailers, for example, are constantly trying to balance the fluctuations in sales and inventory purchases. It’s hard to pay for clothing, food and other merchandise for your store when you haven’t had any customers purchase the products yet. Their solution is to accept credit cards. Often times they are paying credit card companies (Visa, Mastercard, AMEX) 2-3% to process these transactions and pay them up front so that they don’t have to wait for checks to clear or cash to be balanced and deposited.

In transportation, carriers are turning to factoring. Hiring a factoring company is a great solution for managing cash flow, and can also free up your time from burdensome collection calls. Let’s look at another example.

EXAMPLE #2

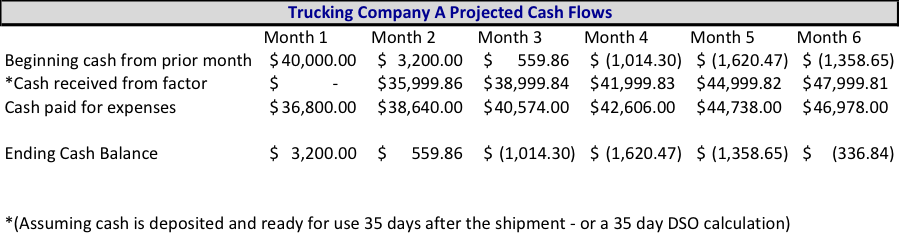

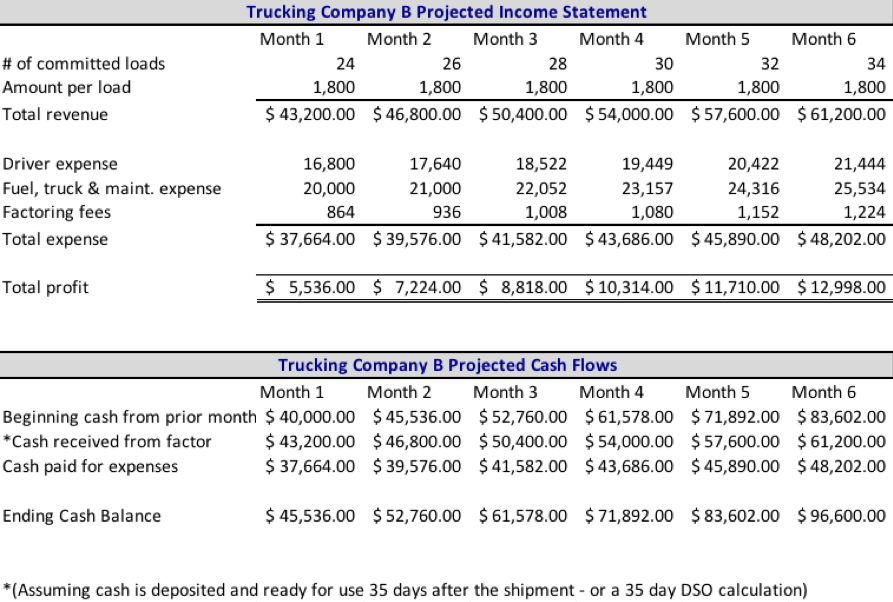

Trucking Company B is starting out with the exact same things as Trucking Company A. The only difference is that they have decided to hire a factoring company to handle all of their cash flow and collection needs for a discount rate of 2%. Here’s how their financials look:

At first look, it may appear that the financial performance of the company is weakening due to a new factoring expense and a slightly modified profit number. However, when taking cash flow into consideration, it is easy to see that Trucking Company B is thriving and in a comfortable position to pay expenses and invest in the future, while Trucking Company A continues to spin its wheels.

When building out the future performance of your company, be sure to put the appropriate focus on maintaining cash flow and not just on your income statement. Without appropriate cash flow, your company will be strained and face investment limitations for the future.

– Ryan Lavigne, VP England Carrier Services

###

The England Carrier Services (ECS) division offers a variety of services for carriers ranging from maintenance to support. As ECS members, carriers have access to nationwide discounts on fuel and tires from dedicated team members who are committed to finding the best price. ECS also provides factoring services with benefits such as same-day funding to a bank account or fuel card. These options allow carriers the freedom to focus on growing their business while saving time and money.